March 2024 Market Recap

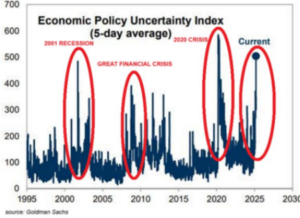

Stocks continued to surge in March with all three major indexes setting new record highs. Strong economic reports and growing anticipation of interest rate cuts by the Federal Reserve (Fed) continue to buoy investor sentiment and stoke buying. The latest housing and mortgage rate data points to a housing market that appears to be on the upswing, with buyers coming off the sidelines and inventory on the rise. While inflation remains a concern for the Fed, the latest job report indicates less upward pressure on inflation than originally estimated. Investors are anticipating three rate cuts later this year, which should keep markets on a positive trajectory.

Markets Keep Climbing

The stock market continued to outpace expectations in March as all three major stock indexes finished the month in record territory. The broad market S&P 500® (SPX) led the way in March, gaining 3.1% compared to February. The popular Dow Jones Industrial Average® (DJIA) and tech‐heavy NASDAQ Composite Index (COMP) also recorded strong gains on the month, moving up 2.1% and 1.8 %, respectively. The markets are now on a five‐month upswing that shows little sign of slowing.

Driving the surge appears to be a steady stream of positive economic reports, including strong economic growth, a powerful jobs market, and a generally bullish outlook for businesses. Whereas the majority of the growth to this point has been attributed to the so‐called “Magnificent Seven” (companies like Apple, Microsoft, and Tesla), growth has been more widespread in recent weeks. Inflation appears to be moderating, but not enough to convince the Fed to commit to lowering interest rates in the near term. But even that reluctance is not tamping down interest in stocks. The yield on the 10‐year Treasury note continues to fall as well, indicating a significant appetite for riskier assets like stocks.

Home Sales Soar in February

Taking the markets and investors by surprise, sales of previously owned homes soared in February to the highest level in a year, according to the latest data from the National Association of Realtors (NAR). Home sales – which make up most

of the housing market – rose 9.5% in February compared to January. That translates to an annualized rate of 4.4 million units, marking the second straight month of rising sales. Driving the robust results was a sharp increase in the number of homes coming into the market. Total housing inventory rose 5.9% in February, compared to the prior month, to just over 1 million units. Compared to a year ago, those numbers are up 10.3%.

Shoppers are accepting the reality that interest rates may never return to sub‐4% levels and are no longer sitting on the sidelines. According to Lawrence Yun, NAR’s chief economist, “What happened in the past two years when we had a historically low inventory level is that many people who would have moved in normal circumstances just delayed…They said ‘I have my 3% mortgage rate, I don’t want to give it up,’ so many people simply delayed. But they can no longer delay.” CNN

Mortgage Rates Fall

The average rate on the benchmark 30‐year fixed rate mortgage fell to 6.79% last week from 6.87%, according to mortgage buyer Freddie Mac. The rate now stands significantly below its 23‐year high of 7.8%, which it reached last October. Costs for a 15‐year mortgage – which is popular with homeowners refinancing their home loans – average 6.11%, also below its peak from last October. While the 30‐year benchmark loan remains well above the 4.67% rate from two years ago, it appears that buyers are accepting that rates are unlikely to drop dramatically in the near term. As a result, home buyers are beginning to come off the sidelines and buy homes at unexpected rates, evidenced by February’s robust home sales report. And while the Fed’s stance may not be what was just a few months ago, the central bank still plans to cut rates three times this year. That should provide more downward pressure on mortgage rates and encourage more activity in the housing market. AP News

Job Market Still Strong

The US added 275,000 jobs in February, exceeding expectations that called for 198,000 new jobs, according to the latest report from the US Bureau of Labor Statistics. Healthcare led the way in job creation in February with 67,000 new jobs. The government was also a big contributor, adding 52,000 jobs, while restaurants and bars added 42,000 jobs.

However, the report also revealed significant revisions of prior estimates. January’s numbers were revised down to 229,000 from an initial estimate of 353,000. December’s results were also revised down to 290,000 jobs from 333,000 jobs. Average hourly earnings – which is watched carefully as an inflation driver – rose just 0.1% for the month, slightly below expectations. Compared to a year ago, wages were up 4.3%, slightly below the 4.4% estimated and off the 4.5% pace set in January. The unemployment rate rose to 3.9% from 3.7% in January. All told, the report is unlikely to cause the Fed to change course from cutting rates this year, although the size and timing of the cuts remains unclear. CNBC

This research material was prepared by Tifin Marketing Automation.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward‐looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

The Nasdaq Composite Index is a market‐capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange‐traded funds (ETFs) or debentures.

The Dow Jones Industrial Average (DJIA) is a price‐weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but includes financials and other service‐oriented companies. The components, which change from time to time, represent between 15% and 20% of the market value of NYSE stocks.