MITIGATING LOSS, MAXIMIZING GAIN

Risk Management

Optimized strategies to protect and grow wealth.

Personalized Protections

Adaptive Risk Navigation

Risk management has many components and will mean something different to everyone based on their level of wealth, tolerance for risk, family dynamics, and other factors. It is also something that will evolve and change with your lifestyle and should be reviewed on a regular basis.

Diverse Threat Defense

Comprehensive Risk Mitigation

By and large, many people think of stock market volatility when they hear the term risk as it relates to their wealth. However, there are numerous risks that need to be considered when carefully planning your financial future. The sequence of returns, longevity, inflation, geopolitics, and legislation are but a few of the many risks that can impact your wealth. A sound financial plan should have a process in place to mitigate such risks.

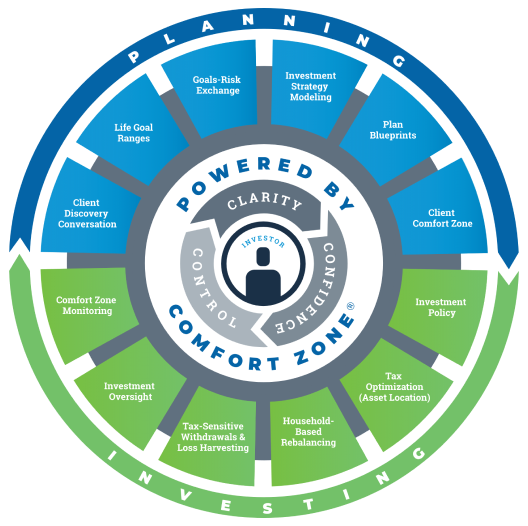

PLANNING & INVESTING

Our Process

Wealthcare’s patented process is designed to help you reach your life goals, while minimizing unnecessary investment risk or needlessly sacrificing your life now.

Our process is dynamic and continual, as is life, and it will guide you through the entirety of your financial life.

PLAN FOR SUCCESS

Financial Plans Increase Confidence

A Charles Schwab survey found that 54% of planners felt “very confident” they would reach their financial goals, compared with only 18% of non-planners.

* Source: Charles Schwab

Planners Confidence*

Non-Planners Confidence*

WATCH

Risk Management 101

Risk Management – defined.