MANAGE YOUR ESTATE

Estate & Legacy Planning

Provide a secure future for your loved ones.

ESTATE AND LEGACY PLANNING

Establish A Legacy

A comprehensive estate plan should help to achieve your objectives and legacy goals. In general, your assets can pass on in three distinct ways:

- Contract law (naming a beneficiary)

- Ownership

- Probate process

A properly structured estate plan can help maximize the efficiency of your wealth transfer to the next generation or charitable endeavor. This is critical not only to maximize value but perhaps, more importantly, to minimize the burden on your loved ones or whoever will help in the settlement of your estate.

OPTIMIZE YOUR LEGACY

Financial Gifting

Another important component of Estate Planning is Gifting to family and charitable organizations. If gifting is important to you, we will guide you through the most sensible and tax-efficient approach to ensure your dollars can make the most impact.

*Additional cost for legal work may be incurred with legal partners depending on your specific circumstances.

PLANNING & INVESTING

Our Process

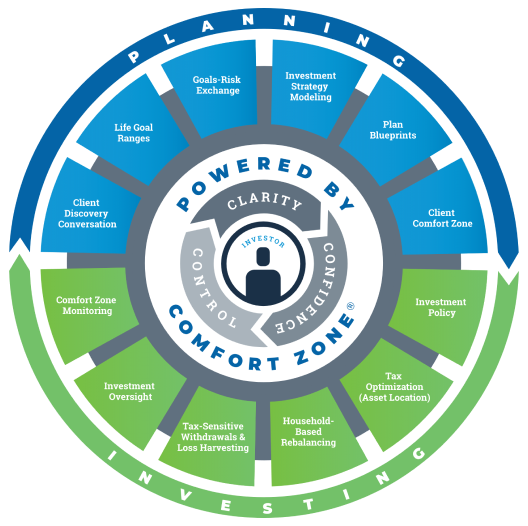

Wealthcare’s patented process is designed to help you reach your life goals, while minimizing unnecessary investment risk or needlessly sacrificing your life now.

Our process is dynamic and continual, as is life, and it will guide you through the entirety of your financial life.

BASIC FACTS ABOUT SOCIAL SECURITY

Should I File Now or Later?

Social Security benefits continue to increase between 6 and 7 percent for every year they delay up to their “full retirement age” (FRA). Your FRA is between ages 66-67 depending on your birthday. After that, it will increase by 8 percent every year between FRA and age 70.

AGE 62 - FRA*

FRA - AGE 70*

WATCH

Wealthcare’s Bucket Conversation

Wealthcare’s approach to financial advising.