MANAGE YOUR RETIREMENT

Income Planning

Plan for a secure and comfortable financial future.

monitor, measure, & track your progress

Keep Life Changing Events and Your Portfolio In Sync

INCOME PLANNING

Secure Your Retirement

If you are approaching retirement, you may be wondering how you are going to replace your paycheck once the big day finally arrives. A transition to retirement essentially means you are now converting from a saver to a spender.

An efficient income plan is paramount to stretch your money as long as possible and there are many factors to consider.

RETIREMENT PLANNING

Manage Your Retirement

Whether you are approaching retirement or already retired, the most important concept to understand is something referred to as the “sequence of returns risk”. Simply put, it is the risk of redeeming your assets for income while the market is performing poorly (i.e. selling low). We will help you manage fluctuations in the market to generate a more risk-efficient and tax-efficient income stream.

PLANNING & INVESTING

Our Process

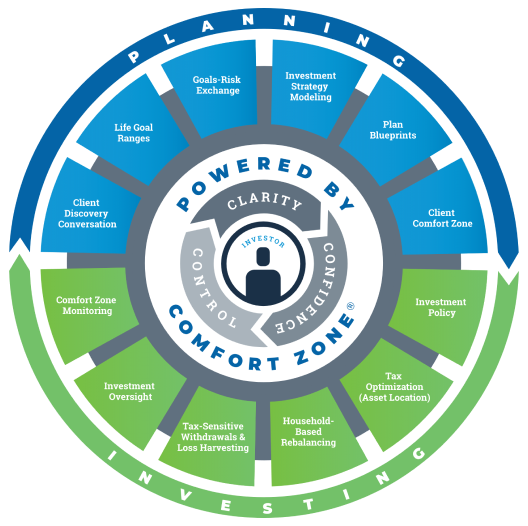

Wealthcare’s patented process is designed to help you reach your life goals, while minimizing unnecessary investment risk or needlessly sacrificing your life now.

Our process is dynamic and continual, as is life, and it will guide you through the entirety of your financial life.

STAT SUBHEAD

Roth vs. IRA

Roth 401(k)s are now permitted for nearly 90% of retirement plans. If your employer is among them, you may be wondering how a Roth 401(k) differs from a Roth IRA. In 2022, you can stash away up to $20,500 in a Roth 401(k)—$27,000 if you’re age 50 or older. Roth IRA contributions, by comparison, are capped at $6,000—$7,000 if you’re 50 or older.

ROTH*

IRA*

WATCH

Goals-Based Investing

Our financial services are designed to work for you, and are based on your needs and goals. We will provide real-world, achievable strategies, analytics, and recommendations so that you have a better financial present and future.