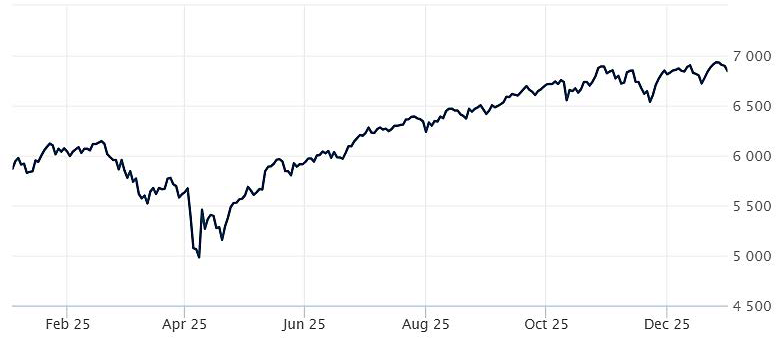

The market narrative in 2025 was dominated by tariffs, artificial intelligence, and questions about the direction of U.S. relationships with the rest of the world. For investors, this resulted in a wild ride, but in the end, investors who stayed invested did just fine, another reminder of the benefit of having a plan and sticking to it. Stocks closed out the year with a bang, sending all major indices into double digit territory. The year capped another record for stocks but worries over potential AI-driven risks continue to emerge. The latest economic growth figures were solid while the late jobs report showed a softening labor market. Not surprisingly, the Federal Reserve (Fed) lowered rates in December but appears to be ready to hit the pause button for now.

Stocks End 2025 With Strong Gains

Despite flat returns in December, investors finished 2025 with double-digit gains. Leading the way higher was the tech-heavy NASDAQ Composite Index (COMP), which gained 20.4% in 2025. The broad market S&P 500® (SPX) and the popular Dow Dow Jones Industrial Average® (DJIA) also rose, gaining 16.4% and 13% respectively.

Stocks rallied in 2025 despite significant headwinds, including a shaky interest rate environment, a chaotic series of tariff policies by the Trump administration, and a record long government shutdown. Many economic indicators posted strong results during 2025, and the latest economic growth numbers continue to show solid growth. However, a deteriorating jobs market and stubborn inflation continue to annoy Fed policy makers and investors.

More worrisome is that many now believe the multi-year advances in stocks is tied to an increasingly risky bet on AI. That bet has produced lofty valuations at best and sky-high at worst. Promised productivity gains and margin improvements have yet to emerge. The earnings concentration in AI-supported mega-cap tech stocks could also translate earnings disappointments into significant downward pressure on all stocks.

Economic Growth Surges Past Expectations

The US economy grew at a better-than-expected pace during the third quarter, according to the latest data from the Bureau of Economic Analysis. US gross domestic product (GDP) grew at a 4.3% annual rate during the July to September period, far outpacing estimates of 3.2%.

Consumer spending gained 3.5% compared to a year ago. Corporate profits rose at an annual rate of 9.1% compared to a year ago.

This was the first estimate of third quarter annual growth and was originally scheduled for release in October but was delayed due to the government shutdown. This release will also replace the second estimate that was scheduled for November. The government will release the final third quarter estimate of growth in January. CNBC, BEA.

Hiring Slows as Labor Market Cools

The US economy added 64,000 jobs in November, according to the latest data from the Bureau of Labor Statistics. The results were better than estimates, which called for a gain of 40,000 jobs. The report offers the first look at the state of the US job market following a 6-week hiatus due to the government shutdown. The report also included partial data from October, which showed a loss of 105,000 jobs that month. August and September were also revised down by a total of 33,000 jobs. The unemployment rate during November was 4.6%, the highest level since September 2021.

The data suggests that many employers are hitting the pause button on hiring. Driving the reluctance to add workers is the uncertainty surrounding trade policy, a murky outlook for interest rates, and the potential unfulfilled promises surrounding AI.

While the report was much anticipated, many are taking it with a grain of salt given the questions surrounding data reliability and completeness directly following the shutdown. The Fed will likely place more emphasis on the December jobs report, which will be released in early January. CBS

Fed Cuts Rates Again, Signals Pause Ahead

Not surprisingly, the Fed reduced its key interest rate by a quarter-point following its December meeting. The federal funds target rate now stands at the range of 3.5% to 3.75%. The move marks the third reduction in 2025 which follows three reductions in 2024.

According to the Fed’s statement, “available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up through September. More recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated.”

During a news conference, Fed Chair Jerome Powell suggested that following the recent cuts, the Fed may take a breather from rate reductions. He said that he “will carefully evaluate the incoming data,” while adding that the Fed is “well positioned to wait to see how the economy evolves.”

During a news conference, Fed Chair Jerome Powell suggested that following the recent cuts, the Fed may take a breather from rate reductions. He said that he “will carefully evaluate the incoming data,” while adding that the Fed is “well positioned to wait to see how the economy evolves.”

Powell also said that inflation could increase to start off 2026 as the costs of tariffs begin to work through the economy. After that, he said prices may come down. AP News, Federal Reserve

A Look Ahead

As we turn the page into 2026, the outlook season is upon us. This is when every bank releases their stock market forecast for the upcoming year. These have been shown to have zero predictive power and should be viewed as nothing more than “content creation.”1 However, we do need to be mindful of current trends, economic reality, and historical analysis to try and position portfolios to meet acceptable risk vs. reward standards. Furthermore, 2026 is shaping up to be an interesting year for several reasons: we will have a new Fed chairman, more clarity on the impact of tariffs, and mid-term elections, which will be a referendum on the Trump Agenda. Another item likely to be front and center is the “Affordability Crisis”.

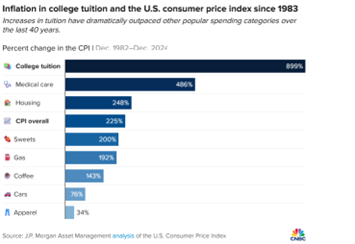

The affordability crisis is the growing situation where people struggle to pay for the basic necessities of life. The chart nearby shows how much college tuition, medical care, and housing prices have outpaced broad-based inflation.

The affordability crisis is not just hitting the lower- and middle-income cohorts but is increasingly affecting the upper-middle class, as Michael Green, a portfolio manager and strategist at Simplify, wrote in a viral Substack post showing his own calculations of essential living costs (housing, childcare, healthcare, transportation, food, etc.). He estimated that a family of four would need roughly $136,000–$140,000 a year just to cope, not live comfortably.

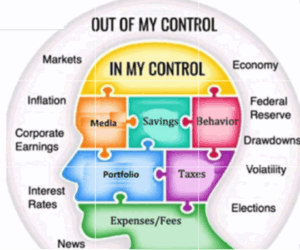

Historically, market volatility in the 2nd year of a 2nd term presidential cycle has been especially high and it would not be surprising to see a significant correction given the multi-year run in equity prices. We will not try to time such correction, but we will maintain our discipline to manage risk and re-balance when appropriate. Your plan should always be the center of your financial decision-making as we focus on the few variables we can control. This provides you with a sense of confidence, clarity, and control to kick off the New Year.

Sincerely,

Ayad Amary, MBA, CFP®, AIF®

Founder| Wealth Advisor

Wealthcare of The Lehigh Valley