Living Their Best Lives

After two years of pandemic anxiety, this past quarter witnessed the return of full in-person commencements. The hard work, discipline, and perseverance of recent college graduates are inspiring. Thankfully, they will be able to enjoy traditional graduation processionals and parties. However, for investors, this past quarter felt like a bad hangover after one of those parties. Year to date, the traditional 60% equity /40% fixed income(1) portfolio is down 12.5%, its worst start since 1962. For the quarter, the broad-based Russell 3000 Equity Index was down 18.1%. It was not only equities. Bonds, as measured by the 7-10 Year Treasury, the “safe-haven” asset, also posted a 4.3% loss.

Two numbers symbolize what has been driving the markets this past quarter: 8.6% and 2%. 8.6% is the white-hot inflation rate, and 2% is the long-term target for inflation. There is a huge gap between 8.6% and 2%. Moody’s economists(2) estimated Putin’s War is responsible for 3.5% of this gap, and Covid related supply chain issues contributed another 2%. The Federal Reserve was late to the game to try to quell surging inflation but has recently reacted by reducing liquidity and raising interest rates

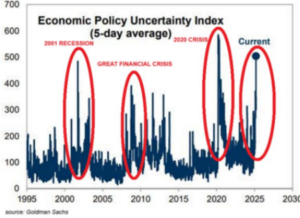

As we look forward, the primary question is how long and how high will this new inflation regime last? Likewise, will the Fed be able to engineer a soft-landing, or will future interest rate hikes topple the economy leading to a hard landing? Given the disparate sources of inflation, geopolitical conflicts, and persistent Covid supply-side disruptions, it is difficult to forecast with great certainty. To illustrate this uncertainty, the Philadelphia Fed’s Survey of Professional Forecasters estimates that this quarter’s real GDP growth to be 2.3%. Conversely, the Atlanta Fed’s GDPNOW model estimates a contraction of 2.1%.

That said, we do know that the current inflation regime alters the investment landscape by creating higher volatility portfolios. We also know that historically following a drawdown, the S&P 500 goes on to produce an average return of 33% over the following 12 months. Given this environment, for long term investors, diversified, low-cost portfolios which provide exposures to a wide range of economic outcomes is the best course.

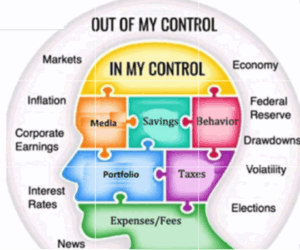

To those recent grads starting their working and investing careers, congratulations. Consider the market pullback a gift. Keep contributing aggressively through these down markets. To those of us whom are older, we know how stressful the current environment is. Markets are down, and prices are up. We think a better way to invest is to have a plan which prepares you for times like this when the market quickly falls. It should also prepare you for when the market quickly goes up (like it did right after the pandemic started). Just as some four-year college plans morphed into something unexpected, our plans will need to adjust as life changes and markets gyrate. It should be a plan that lets you stay invested for the long-term and focuses on goal attainment. If you want to review your investment plan, feel free to reach out to me.

1) Source: MPI Stylus: Equities Index is the Ibbotson Stock Index/Russell 3000. Bond Index utilized is Ibbotson Long Term Government.

2) Source: BLS, Moody’s Analytics https://twitter.com/Markzandi/status/1536075313741971456/photo/1

©2022 Wealthcare Capital Management LLC (“Wealthcare”) is a registered investment advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisors Act of 1940. All Rights Reserved. This content is for educational purposes only and not to be considered a solicitation for the purchase or sale of any security and should not be relied upon as financial, tax, or legal advice. The views expressed are those of the author/presenter and all data is derived from sources believed to be reliable. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. Information contained herein is at a point in time and subject to change without notice. Information is derived from sources which are believed to be reliable, but are not independently audited. Wealthcare cannot guarantee any specific financial return results for any client. Past performance is not a guide to future returns.

Disclaimer

This article is intended for informational purposes only, and should not be considered financial, investment, business, tax, or legal advice. You should consult a relevant professional before making any major decisions.