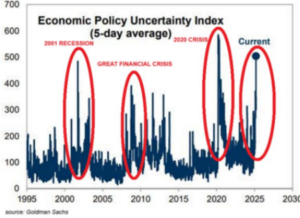

During the 2nd quarter of 2025, the news cycle was fast and furious. Following Liberation Day, volatility exploded, and a 20% drawdown ensued under the premise that tariffs would result in higher inflation and lower corporate earnings. The Federal Reserve kept interest rates unchanged due to the expected inflationary pressures from these tariffs and anticipated deportations. To close out the turbulent quarter, we witnessed US forces bomb Iran, and if that was not enough, a Socialist won the primary in the NYC mayoral election. Despite these challenging events, both the stock and bond markets climbed this “wall of worry” with the Russell 3000 up 11.0% and the bond market up 1.2% for the quarter. In times like these, it is wise to remind ourselves to focus on what we can control.

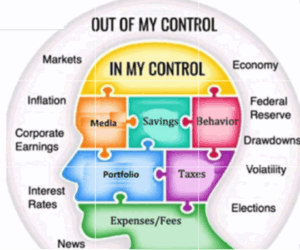

As you can see from the graphic, certain elements are categorized as OUT OF MY CONTROL (elections, inflation, interest rates). Others are classified as IN MY CONTROL (media consumption, saving, behavior, portfolio, taxes and fees). As investors, we are better off focusing on controlling the controllables. Controllables are within your power to influence and provide a foundation from which you can build a more robust and resilient investment strategy. We highlight each of the items under “IN MY CONTROL” below.

Media Consumption: We should be cautious about relying on the media to provide sound unbiased investment advice. The media’s business model is to maximize views and clicks. However, when we inevitably fall prey to their clickbait, remember the “fallacy of forecasts.” Even the best Wall Street analysts struggle to accurately predict next year’s S&P 500 returns. In 2022 and 2023, they forecasted on average a 1.2% and a 6.8% return respectively, versus actual returns of ‐19.4% and 24.2%1. Big misses! Celebrity financial gurus are no better. One such “guru”, Guy Kiyosaki, author of “Rich Dad, Poor Dad,” has been predicting a stock market crash since 2016. Had you followed his advice, you would have missed out on doubling your money during the period, resulting in a “Rich Dad Poor Reader“2 situation.

Savings: Do you know the neighbors of lottery winners are more likely to increase their spending, take on more debt, and put more into speculative investments? You’ll never be content trying to keep up with the Joneses because there is an endless supply of them to keep up with. Instead, set your savings policy to achieve your goals and adjust as market conditions or individual circumstances dictate.

Behavior: The emotional cycle of investing is a concept within behavioral finance that describes how investors’ emotions influence their decisions as markets rise and fall. When markets are rising, investors’ emotions propel them to buy out of greed. Conversely, when markets are tanking and cheap, investors sell out of fear. These actions are counterproductive to achieving long‐term financial goals and produce subpar returns. Morningstar estimates that fund investors have lagged the very funds they owned by 1.7% annually over the 10‐year period (2013‐2022) because of overtrading and performance chasing.

Portfolio: Wealthcare’s Investment Choice Framework is designed to help you get the big decisions right. What are the big decisions? For this, we turn to research from Yale professor Roger Ibbotson, 3 where he asked the question: What are the key drivers of portfolio return and risk? After a series of regressions, he concludes that approximately 75% of your return and risk are driven by your risk allocation, or your overall equity to fixed income mix. Risk Allocation is the first big decision. The remaining 25% is split between your asset class allocation and active risk decisions. Your asset allocation decisions reflect your preferences regarding the geographic orientation of your portfolio and the assets classes asset classes you own within equities (large cap, small cap, international etc.) and fixed income (Treasuries, credits, mortgages, etc.). Your active risk decision reflects your preferences regarding active versus passive investments. These big decisions – risk allocation, asset allocation and active risk – are key investment policies that will drive your investment experience. The goal of the Choice Framework is to facilitate selecting a portfolio based on your goals and your investment policy preferences.

Taxes: The One Big Beautiful Bill Act (OBBBA) has become law. We are still learning about what is in the more than 1,000 pages of the bill and its potential impacts. However, tax rates and the estate tax exemption that were set to expire under current law have been made permanent. The OBBBA will impact strategies to reduce your lifetime taxes which we can discuss in our next planning meeting.

Expenses and Fees: It’s crucial to assess whether the potential for higher returns justifies higher expense ratios and fees. Moderately priced active management may make sense when evaluated relative to the risk profile of the fund, asset class and confidence in the manager. High‐cost passive and high‐cost active are likely an unforced error.

It is hard to imagine a more volatile quarter than the past, but the ongoing tariff saga and market reaction to the Trump mega‐bill will likely keep markets on edge. As such, focusing on the “controllables” offers reduced anxiety, improved decision‐making, and increased confidence.

Feel free to reach out to me to discuss further.