Financial professionals weigh in on the worst mistakes they see investors making, and what to do instead

Bear markets are an extraordinary opportunity — for both good and bad outcomes.

I’ve already written about the positive aspect of this sort of opportunity, but this time I want to concentrate on some of the nastier ways investors hurt themselves in down markets.

Now we can move on to seven ways investors self-inflict harm on themselves when the market crashes.

7 Worst Investor Mistakes in Down Markets and What to Do Instead

Unfortunately, some of the worst financial mistakes come during or after a market crash, when people can’t take the pain.

Here’s what several financial advisors listed as some of the worst investor mistakes they’ve seen clients make when the market tumbles, along with their advice on how to avoid these.

First Mistake

Several advisors warned against making quick moves in your portfolio out of fear. Danielle Miura, CFP®, founder and owner of Spark Financials says, “If you make any quick moves to your account out of fear, you’ll likely only make things worse.”

Miura suggests instead to revisit your plan and contact your financial advisor, “This is the time to revisit your financial plan. It can be a good reminder of why you invest and what’s important to you.

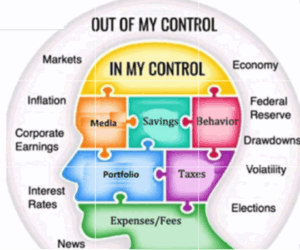

“If you have a financial planner, set up a meeting with her or him to discuss your concerns and ask how your goals should change based on the dip in the market. Focus on things you can control. Unfortunately, stock market fluctuations are not one of those. Instead, focus on building your emergency fund, creating or modifying your budget, or paying off high-interest debt.”

Kelly Klingaman, CFP®, RLP®, Founder & Financial Planner at Kelly Klingaman Financial Planning agrees, “The biggest mistake I see investors make during a bear market or times of uncertainty and volatility is touching their portfolios at all. A change in markets shouldn’t prompt a change in your investment plan.”

Rather, Klingaman says changes to your investing and financial plan should come from changes in your life goals and plans, “Those kinds of decisions should be prompted by a change in your personal life circumstances. Maybe your first baby is on the way and it got you thinking about how you could help pay for college in 18 years, or you’d really like to save and buy an investment or vacation property in the next 5–10 years.

“Perhaps you want kids in the future, but first, you’d like to take a break from your corporate gig and travel the world on a year-long sabbatical while you still have the chance. Maybe you want to work hard and save aggressively to give yourself early financial independence in your 40s. Any of these points of inflection in your life, these times you pivot in pursuit of new dreams and goals, can be served and supported by properly aligning the mid-term and long-term buckets of your investment portfolio.”

Second Mistake

Miura believes far too many people think of a market crash as a disaster, failing to take advantage of it.

Instead, she says, “Think of a market crash as an opportunity, not a disadvantage. An opportunity to buy stocks at lower prices, which can help you benefit from larger gains in the future.”

Third Mistake

Miura sees too many people reacting badly to incessant financial news.

She says, “Avoid looking at your investment accounts daily. For some, this may mean deleting your brokerage firm’s app on your phone or keeping yourself busy. Unfortunately, looking at your investments every minute doesn’t make it go up.

“The news is everywhere these days from social media to the TV. It’s very difficult to escape from the news, but that news may not be accurate and/or may not apply to you. Before you assume it’s correct, fact-check it online or ask a professional.”

Eric Maldonado, CFP®, MBA, Owner, Aquila Wealth Advisors, LLC goes even further, “Stop watching so many financial news shows! Avoid checking financial articles every day. These shows and articles are paid to get views, so their headlines are designed to elicit an emotional response.

“By reading these headlines and watching these shows daily, you feed your anxiety. We don’t need more worry and stress when the economy or the market pulls back. If you want to read, spend more time reading classic books and timeless texts. Alternatively, spend more time outside getting fresh air. It’s summertime, enjoy the weather!”

Fourth Mistake

Michael Raimondi, Wealth Manager with Clarus Group cautions to not overdo things and bury your head in the proverbial sand. He says, “A big mistake investors make is not communicating with their advisors and turning a blind eye.”

He reminds us that advisors are most helpful when things aren’t working as we’d like them to, “This is when we advisors earn our worth — we maintain our focus on planning, risk management, reviews, and the income components of one’s portfolio. These are good conversations to have with your advisor during market downturns.”

Ayad Amary, MBA, CFP®, VP and Senior Wealth Advisor at Wealthcare of the Lehigh Valley couldn’t agree more. He says, “During bear markets, investors commonly choose to ignore what’s happening. They stick their heads in the sand — they don’t look at their statements nor engage with their advisors until the market recovers because it may be too painful to acknowledge.”

Instead, he suggests doing something different, “While ignoring what’s going on could save you from panic selling, it would make a lot more sense to use a bear market to your advantage.

Fifth Mistake

Several advisors point out that failing to take advantage of market downturns for converting traditional IRAs, 401(k) plans, etc. to their Roth equivalents can be a huge missed opportunity.

Amary expands on his earlier thoughts, “One powerful strategy to consider during down markets is the Roth conversion. Depending on your tax situation, and assuming you have money in a Traditional IRA or other tax-deferred vehicle, executing a Roth conversion during a down market can greatly improve the tax efficiency of your overall portfolio in the long term.

“When you convert assets to a Roth, they’re treated as taxable income in the year of the conversion. If you make the conversion when the market is down, you pay less tax for the conversion. Then, you reap the rewards of tax free growth when prices rebound.”

Cecil Staton, CFP® CSLP®, President & Wealth Advisor at Arch Financial Planning, LLC echoes that, “Investors should consider making Roth conversions. If you’re in a lower income tax bracket now relative to your future, Roth conversions could make sense. Roth conversions when the market is down give you more future growth in your Roth accounts rather than traditional pre-tax IRA or 401(k) accounts.”

Sixth Mistake

Staton points out to another opportunity many people miss — tax-loss harvesting, which can turn a negative — stock value losses — to a positive.

He recommends investors “consider tax-loss harvesting, as this can provide significant tax benefits during bear markets. When you sell an asset at a loss, the government lets you deduct some of that against current and future capital gains income. This can save you up to $3,000 per year of ordinary income.”

However, note that doing tax-loss harvesting right can be complicated, and defers the tax owed rather than canceling it.

Seventh Mistake

Jay W. Rishel, CFP®, of Overman Capital Management reminds us to avoid focusing just on the investment management aspect of our financial lives. When stocks are down and our net worth drops, we tend to over-focus on that.

Instead, he says, “Focus on the aspects of your financial plan that you can control. Frankly, failure to update or take action on aspects of your financial plan other than investment management could be just as, if not more, detrimental than a bear market.”

He recommends taking the following actions:

- “Make sure your estate plans are in order, i.e., living will, power of attorney (POA), healthcare POA, guardianship, etc.

- “Review beneficiaries on your retirement accounts.

- “Revisit your monthly cash flow. Are there ways to lower discretionary expenses and increase savings?

- “Do you have enough insurance given your current personal and professional situation?

- “Make sure you have sufficient emergency savings (if at all possible).”

The Bottom Line

Going through a bear market isn’t fun.

Frankly, even if you’re not about to retire or already retired, it’s plenty stressful.

However, by avoiding these seven mistakes, and following the above advice instead, you may well come out the other side of the downturn even better off than when you entered it.

Written by Opher Ganel July 7th, 2022

https://themakingofamillionaire.com/7-nasty-investor-mistakes-to-beware-in-down-markets-d381642afd

Disclaimer

This article is intended for informational purposes only, and should not be considered financial, investment, business, tax, or legal advice. You should consult a relevant professional before making any major decisions.