The Challenge

The idea of so‐called Smooth‐Ride strategies is to deliver competitive long‐run returns relative to fixed‐mixed allocations but with less volatility. When equities are down, these strategies look great and garner significant interest. When equity markets are up, FOMO can take over and cause investors to buy at ever‐rising valuations. This is an individual behavioral and cognitive bias problem. It is not an investment challenge. It is an investor challenge.

Wealthcare offers an investment choice framework to help advisors match client preferences and beliefs with plausible strategies for long‐term financial plan success. Our low‐cost, 3 ETF, Pure Gamma strategy is not appropriate for all investors, nor are our Smooth‐Ride strategies. Helping clients land on a strategy that works for them is a significant service advisors provide to their clients.

While the strategies we offer will vary in relative performance over market cycles, all the strategies are designed to offer long‐term results consistent with client preferences and financial plan needs. The challenge is when “preferences” change as a function of market dynamics.

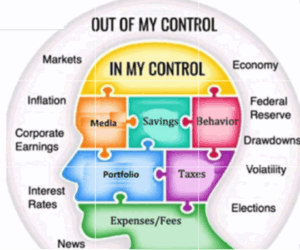

Investors can be easily tempted to make investing mistakes.

The types of investing mistakes I am talking about here are tied to cognitive biases as identified in behavioral economics. One in particular, “Bounded Willpower,” can help explain why we, as advisors, sometimes find it hard to keep a client on strategy during periods of stress. For examples:

- During the internet bubble of the late 1990s, many investors set aside their risk‐targeted strategy. They became risk seekers, increasing their equity and tech exposure because they did not want to miss out on the potential returns of the internet revolution, despite excessively high valuations. As it turned out, from the end of March 1999 to the end of March 2009, the S&P 500 fell by 38% and had a negative annualized return of 3% for the 10‐ year period.

- When the market crashed in 2008/09, many investors set their risk‐targeted strategy aside and reduced equity exposure to avoid additional losses despite the excessively cheap valuations. As it turned out, from March 2009 to March 2019, the S&P 500 rose by 255%, producing an average annualized return of 15.9% when dividends are included.

Bounded Willpower captures the idea that even given an understanding of optimal choice, people will often preferentially choose whatever brings the most short‐term satisfaction over incremental progress toward a long‐term goal. In other words, they trade off long‐term success for short‐term emotional gain. The self‐talk goes:

- “It feels good to take more risk to play for the big internet‐driven returns. I can beat the investment plan.” Or,

- “It’s time to bail on the risk‐target and go to cash so I can get an emotional release from these losses.”

How do we help investors avoid cognitive bias investing mistakes?

Our best tool for this is our patented Comfort Zone® process. When the market was frothy in 1999, clients would likely have been overfunded and, with good counsel, likely would have reduced equity exposure to get back in the Comfort Zone. In 2009, clients would have been underfunded, and taking more risk was a solution to getting back into the Comfort Zone.

Even with the Comfort Zone process, for investors in a conventional portfolio, the wild ride in terms of the ups and downs of their net worth can be a challenge to maintaining Comfort Zone discipline. Investors who have conviction in their strategies are more likely to maintain discipline and avoid behavioral mistakes, particularly during periods of market

stress. So, the trick is to use an investment strategy within the Comfort Zone process that the client believes in, has confidence in its long‐term return potential, and has a “ride” they can accept when market stress hits. Confidence and belief in the chosen strategy are essential to avoiding the flinch when the market falls or the reach when it’s euphoric.

Our Smooth‐Ride Strategies

Wealthcare offers two Smooth‐Ride strategies: DSA (Dynamic Strategic Allocation) and Resilient. DSA implements a portfolio sleeve that we integrate into our conventional strategies at a 25% weight to smooth the total portfolio ride by varying the asset allocation according to the time varying expected compensation‐for‐risk offer by the markets. Resilient offers a set of stand‐alone portfolios that utilize less conventional investments that are less correlated to stocks and bonds to smooth the ride while also seeking additional sources of alpha. For examples, catastrophe bonds and equity options strategies. We also offer Resilient with DSA.

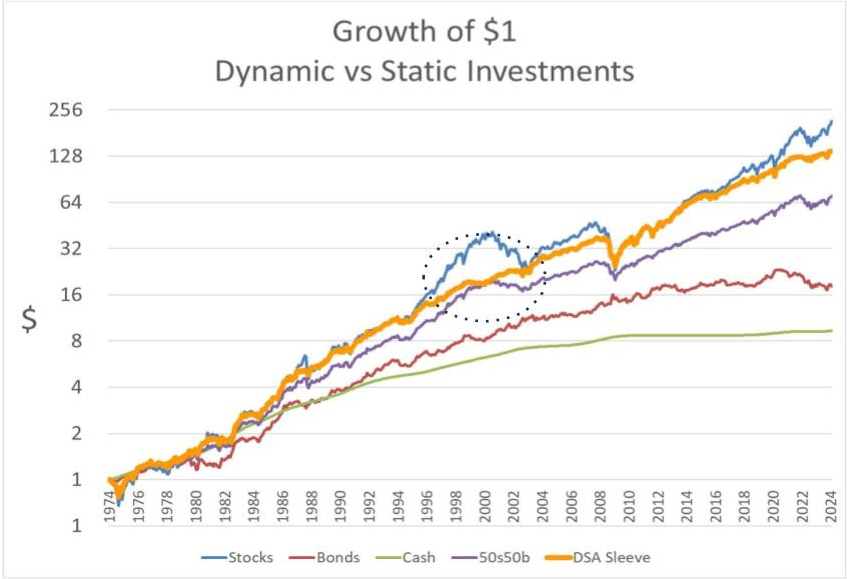

Below is a chart from our strategy research comparing asset growth from 1974 to the present for our dynamic allocation discipline, compared to stocks, bonds, cash, and a 50/50 stock/bond portfolio.

The orange line represents the growth of our dynamic sleeve after deducting 25 basis points in slippage cost per trade. The purple line is a 50/50 stock/bond portfolio, which is the neutral position for the dynamic sleeve. The dynamic sleeve can go from zero to 100% stocks. As you can see, the dynamic sleeve has significantly outperformed the 50/50 portfolio. In annualized return terms, the dynamic strategy outperformed the 50/50 portfolio by more than 1.7% per year. Versus stocks, the dynamic sleeve lagged by just 0.8% per year with significantly less volatility.

The circled area is instructive. From about 1996 to 2002, stocks and the dynamic strategy returned about the same. However, stocks had a run‐up from 1996 to 1999 that crushed the dynamic strategy. Then, from the 2000 peak, stocks gave back all the run‐up and ended in the same place as the dynamic strategy in 2002. The dynamic strategy did not participate in the run‐up nor the run‐down because of its valuation disciplne, producing a smoother ride.

Clients that would have dumped the dynamic strategy during the euphoria are doubtful candidates for our dynamic strategy. Instead, they may be better served with a trend‐following or momentum‐based strategy if they match well from an emotional/behavioral perspective. When an investor in a valuation‐based strategy succumbs to FOMO, they invariably end up in the reach, chasing prices and ending up in a worse place than if they had done nothing.

Now, we are in another period where long‐term expected compensation‐for‐risk is unattractive. The market has run up based on a siren’s song of a Goldilocks economic view and AI euphoria. Euphoria aside, valuation is a patient teacher that requires patient students to achieve success. If you have clients in a DSA strategy that are about to do the reach, it might be appropriate for some “discernment” counseling. We are here to help.

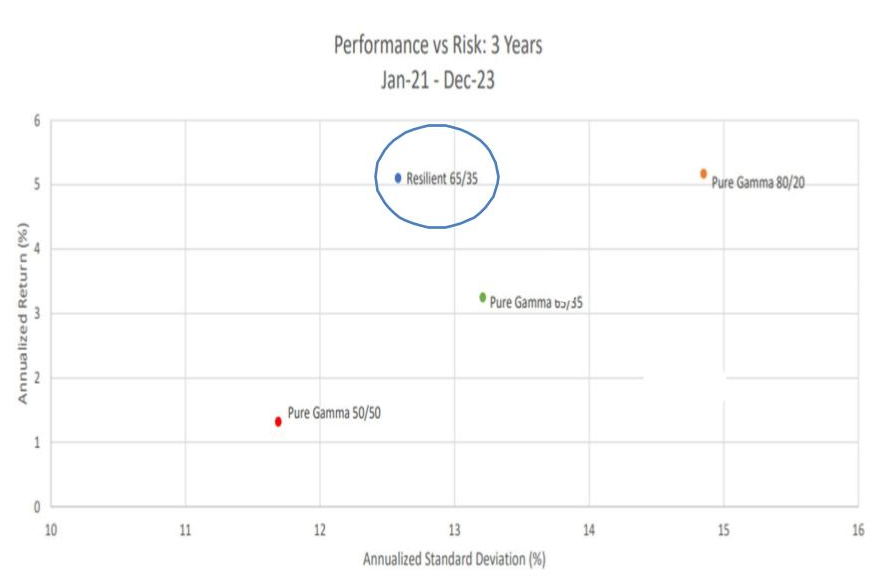

Moving on to our Resilient strategy. This strategy reduces exposure to stocks and bonds (10% each) to invest in less correlated assets with different sources of alpha. Over the past three years, the Resilient strategy has dominated risk‐ equivalent conventional portfolios, as shown in the chart below.

However, after the euphoric stock rally in Q4 of last year, the Resilient 65/35 strategy lagged the conventional 65/35 Pure Gamma strategy by 3.3% for 2023. If a client is likely to sell a Smooth‐Ride strategy (in this case, Resilient) after it lags during a euphoric period, Smooth‐Ride strategies may not be a good fit.

Closing Thoughts

Whether Smooth‐Ride strategies make sense for a client depends on the nature and power of their emotional responses to market ups and downs. Smooth‐Ride strategies tend to flip the experience of market ups and downs.

In a conventional strategy, feeling good happens when both the markets and the portfolio are up, and feeling bad occurs when both are down. In contrast, with the Smooth‐Ride strategy, feeling bad occurs when the market is up but the portfolio is up less, while feeling good happens when the market is down but the portfolio is down less.

So, a client’s response to market stress can help guide us to an investment approach that is a good match for them. Effective strategy matching wrapped in our Comfort Zone® process is a powerful approach to helping clients make better investment decisions and stay on track to meet or exceed their goals.