04/05/2023

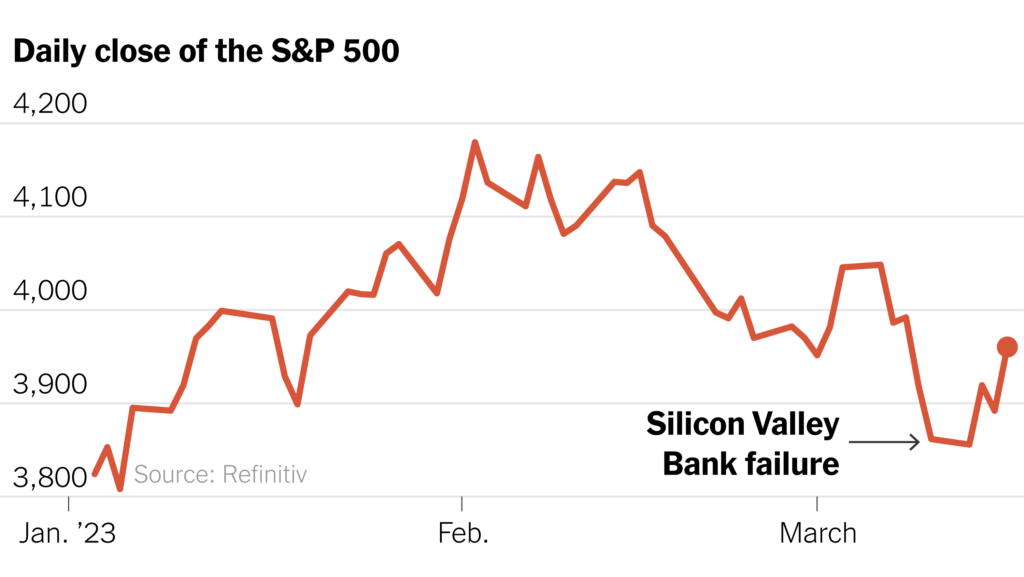

Stocks retreated in March as investor confidence sank following a handful of major shakeups in the banking sector. These included the failures of Silicon Valley and Signature Banks, the hurried acquisition of Credit Suisse by its rival UBS, and the propping up of First Republic by 11 of America’s biggest banks.

Investors flocked to some of the world’s largest technology companies last month. The combined weighting of Apple Inc. and Microsoft Corp in the S&P 500 has risen to 13.3%, representing an all-time high. As market conditions have driven the FAANG stocks down 21% from their August 2021 peak, the two tech giants have claimed a bigger piece of the index. Stocks finished in the green for the second-straight quarter due largely to bounce backs by Big Tech that saw the Nasdaq Composite soar nearly 17% since the New Year. The S&P 500 climbed 7% over the same period. Source: Nasdaq and Axios

Banking Woes Fan Investor Concern

Treasury Secretary Janice Yellen’s reassurances about the stability of the banking industry appear to have eased investor fears somewhat, though many were frustrated by the lack of clarity surrounding the Federal Reserve’s next move. Central Bank chair Jerome Powell and Ms. Yellen both stated their intent to improve regulation of the banking industry, but the Treasury Secretary in particular was noncommittal regarding the prospect of extending insurance on deposits. That lack of clarity dragged the shares of smaller banks downward, reflecting investors’ anxiety about what might happen next. Both Powell and Yellen acknowledged that more oversight is needed in light of recent events, though the Fed chair admitted the central bank’s supervisors had not been effective at preventing problems at Silicon Valley Bank and Signature Bank.

Among the proposed changes were updating stress test models for lenders and giving additional authority to the Financial Stability Oversight Council. Still, Yellen’s reticence surrounding the adoption of universal deposit insurance without congressional approval seemed to negatively impact the market and revived fears that the government may be unsure of how to rebuild depositor confidence. Source: CNBC

Curbing Inflation Still a Priority for the Fed

The Fed intimated that it may finally stop raising rates but Powell didn’t rule out another rate increase or two. In fact, on March 22, the Federal Reserve moved forward with a quarter-point interest rate increase – the ninth straight one – even in the face of the recent banking chaos. This seemed to be a clear signal that, for now, dampening inflation remains more of a concern than the perceived stability of the banking sector. This latest hike pushes the Fed funds rate to the highest it’s been since May 2006. Still, while officials forecast one more rate increase this year, it’s anything but certain. Powell posited that the turmoil hitting lenders now is effectively substituting for additional rate increases.

The move seems to underscore Powell’s confidence in his strategy and his intent to stay the course. Many experts believe, as he does, that even though inflation has shown signs of slowing, there’s more work to be done before prices stabilize. The fight to tame inflation will likely continue to take precedence but may involve less aggressive measures than before, reflecting Powell’s concern about persistent tightness in the labor market and fears about an impending downturn. He indicated that the central bank isn’t done hiking rates and will continue to do so appropriately. Still, many experts worry that further increases in the cost of borrowing could contract the economy too much. Source: CNET

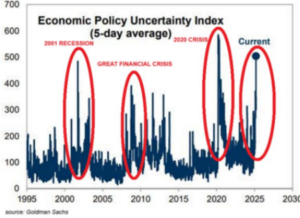

Will the Banking Crisis Cause a Recession?

As if rising interest rates, inflation, and round-after-round of tech layoffs weren’t enough, the bank industry’s recent woes have sent more shudders through an already-jittery US economy. The well-documented troubles of Silicon Valley Bank and Signature Bank as well as several additional bank rescues triggered fears of a contagion that could engulf the economy. The University of Michigan’s closely watched index of consumer sentiment recently fell for the first time in months. The Conference Board’s consumer confidence index is also down, according to the latest data. Does this mean the recession investors have been hearing about for a year is finally on the horizon? Wall Street has been debating the topic for months. While a strong labor market has helped the economy dodge the recession bullet so far, whether that continues remains to be seen, and consumer confidence has much to do with that. Source: CNBC. Additionally, the recent banking concerns may also add to recession fears as credit conditions are expected to tighten across regional and community banks. The silver lining here is that although tighter lending restrictions may cool the economy, it could also help the Fed in its fight against inflation, thereby putting the brakes on future rate hikes.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

©2022 Wealthcare Capital Management LLC (“Wealthcare”) is a registered investment advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisors Act of 1940. All Rights Reserved. This content is for educational purposes only and not to be considered a solicitation for the purchase or sale of any security and should not be relied upon as financial, tax, or legal advice. The views expressed are those of the author/presenter and all data is derived from sources believed to be reliable. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. Information contained herein is at a point in time and subject to change without notice. Information is derived from sources which are believed to be reliable, but are not independently audited. Wealthcare cannot guarantee any specific financial return results for any client. Past performance is not a guide to future returns.

Disclaimer

This article is intended for informational purposes only, and should not be considered financial, investment, business, tax, or legal advice. You should consult a relevant professional before making any major decisions.