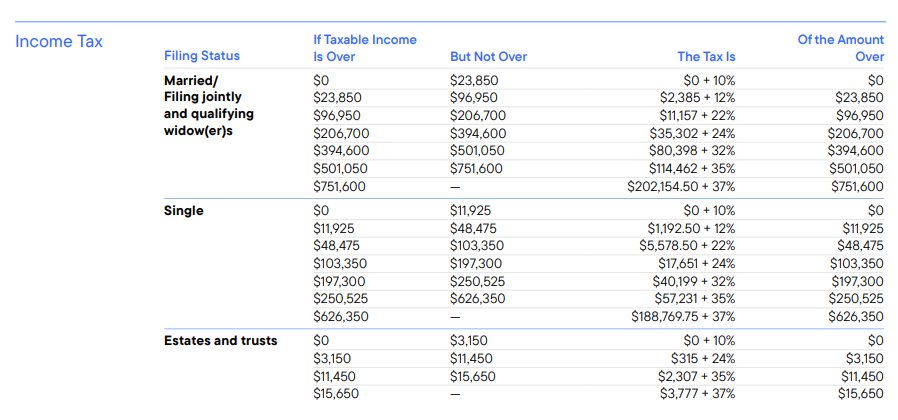

As we move into 2025, it’s essential to stay informed about changes in tax rates, schedules, and financial contribution limits. Whether you’re an individual, a family, or a business owner, understanding these updates can help you plan effectively for the year ahead. This year’s key changes include updates to income tax brackets, capital gains rates, retirement plan contribution limits, and deductions for state and local taxes. Businesses will also find important details about corporate tax rates and deductions for qualified business income (QBI).

For retirement savers, the increased limits on 401(k) and IRA contributions offer expanded opportunities to save for the future. Meanwhile, updates to the child tax credit and health savings accounts (HSAs) provide additional benefits for families. This comprehensive guide ensures you have all the information needed to maximize your financial planning and take advantage of the latest opportunities.

To dive deeper into these updates and learn how they could impact you, click here to read the full document.