In the first quarter of 2025, the Trump administration implemented dramatic shifts in foreign policy, trade policy, and executive power. Vladimir Lenin, the Bolshevik revolutionary and the first leader of the Soviet Union, once said, “There are decades where nothing happens; and there are weeks where decades happen.” This aptly describes the tumult of the past 12 weeks.

Trade and foreign policy changes are precipitating a rotation from the U.S. to foreign equities that have not been seen since 2015. The S&P 500 was down 4.3% for the quarter, while foreign stocks, as measured by the MSCI EAFE, were up 7.0%, a whopping 11.3% difference in one quarter. Even Canada and Mexico were up for the quarter despite tariff risks.

The extent to which the Trump administration has set out to antagonize longstanding allies is surprising. It has been a wake-up call for Europe, and they are responding with massive new spending planned for defense and infrastructure led by Germany. Ironically, President Trump may be guiding them to a new era of growth.

Market participants expected Trump 2.0 to be as good or better for equities as Trump 1.0. The S&P rallied to a post-election high in February on the expectation that the Trump administration would carefully balance inflationary, anti-growth policies (tariffs, deportations) with pro-growth policies (business-friendly deregulation, tax cuts, and lower energy prices). So far, we have gotten the former but not the latter. The market has been unpleasantly surprised.

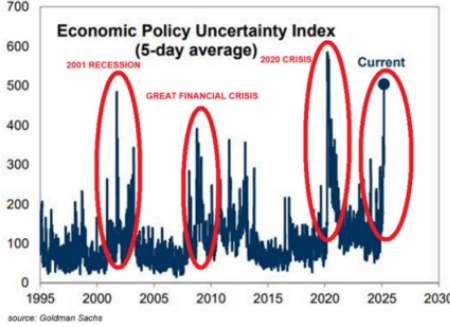

The Goldman Sachs Economic Policy Uncertainty Index spiked to its second-highest rating ever. Only the COVID pandemic spiked higher. The difference? Unlike the COVID pandemic, the current economic uncertainty is self-inflicted.

Perhaps this will be just a short to medium lived jump reflecting the Trump administration’s initial tariff saber-rattling and the DOGE chainsaw. However, the Trump 2.0 uncertainty is creating downstream effects.

The University of Michigan Consumer Sentiment Index (MCSI) fell to 57 for March, a decline of 17 points since December and its lowest level since 2022. Two-thirds of consumers expect higher unemployment next year, the highest reading since 2009. Inflation expectations for the next year hit 5% and 4.1% for the next 5-10 years.

This pivot toward stagflation in consumer expectations is directly tied to President Trump’s evolving, highprofile tariff policy. He has dubbed April 2nd Liberation Day. He plans to roll out widespread reciprocal tariffs on top tariffs he has already imposed in the name of fairness.

The Tax Foundation, a nonpartisan tax policy nonprofit, estimates that Trump administration tariffs will reduce U.S. GDP by 0.4% and hours worked by 309,000 full-time equivalent jobs before accounting for foreign retaliation. They estimate Trump tariffs now affect more than $1 trillion of imports and are expected to rise to more than $1.4 trillion when temporary exemptions for Canada and Mexico expire.

Hopefully, President Trump will provide clarity on tariffs and tariff policy. This is what businesses need, and the stock markets need to stabilize. So far, the Trump Administration has been indifferent to the stock market swoon. They seem to be banking on a scenario where tariff policy takes a backseat to tax cuts and deregulation sometime in the second half, spurring growth expectations. Many market participants are hopeful but uncertain whether the Trump administration can successfully manage the pivot.

Given the uncertainty, thoughtful diversification is paramount. If you would like to review opportunities for further diversification of your portfolio or to review your plan, please reach out to me. As always, we are here to serve.