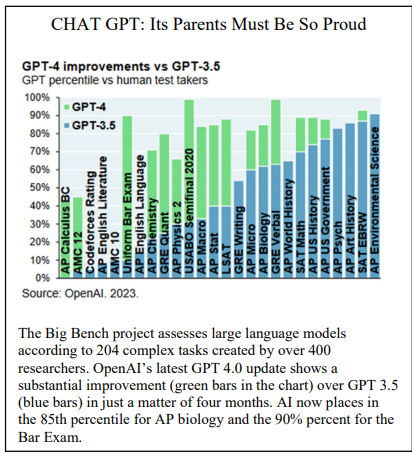

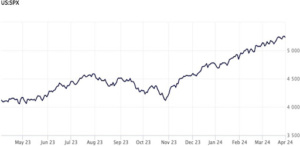

In the second quarter, we witnessed several events which were in large part expected by most market participants, including the continuation of inflation easing, the slowing U.S. economic growth, the near end of the Federal Reserve rate-hike cycle, and the U.S. government debt ceiling resolution. Yet, few expected the strength of the stock market, with the S&P 500 up 8.7% for the quarter with a year-to-date return of 16.9% ending June 30th. What drove these stellar returns? Another unexpected item… artificial intelligence is progressing by leaps and bounds (see above image)

This rapid advancement in AI propelled stocks such as Google, Tesla, Apple, Amazon, Microsoft, NVIDIA, and Facebook. These stocks have been dubbed the Magnificent 7, and they accounted for approximately 80% of the gains in the S&P 500 year to date. To emphasize how narrow the rally has been, compared to the S&P 500’s 16.9% return, the Russell 1000 Value is up 5.1% year to date, and the equal-weighted S&P 500 is up just 7.0% ending June 30th.

The speed and magnitude of the adoption of artificial intelligence has been stunning. ChatGPT, an artificial intelligence chatbot launched in late 2022, surpassed 100 million users in only two months. The raging debate is whether AI will bring us peril, prosperity, or a mixture of both. In the Age of AI, authors Henry Kissinger, Eric Schmidt, and Daniel Huttenlocher, warn against a dystopian future in which AI spreads from reading X-rays and predicting weather patterns to empowering killer robots and spreading disinformation. They warn AI will create massive job losses and weaken national security and state sovereignty unless meaningful regulation emerges

Elon Musk proclaimed fully autonomous driving will be here by the end of the year, which would decimate trucking/taxicab employment. In addition, AI also threatens to displace highly paid workers, from engineers to lawyers, consultants, and money managers (not yet for financial advisors). Anton Korinek, an AI researcher, told Bloomberg News, “This is going to be very different from the past 40 years when blue-collar workers lost out, and white-collar workers benefited from technology progress.”

In contrast, Daniel Rock, a Penn Professor of Operations Research, envisions a more optimistic outcome where AI’s primary role will be to augment workers rather than displace them. While AI may usher in the next productivity boom, others warn if the productivity gains aren’t shared more broadly than the technology -charged gains of the past four decades, economic inequality — with all its attendant harms — will deepen. In short, uncertainty is abundant around the timing and magnitude of the economic ramifications of AI.

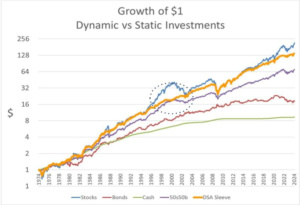

How will AI affect the financial markets and investment opportunities? In recent years, investment managers have begun incorporating AI tools to garner an edge in stock selection. The jury is still out on whether this will actually deliver “alpha” or excess returns, but as with any other form of active management, the ability to develop a competitive edge in a risk-managed framework is challenging. To the extent artificial intelligence makes markets more efficient, indexing strategies will benefit.

In terms of your portfolio, you likely already have exposure to companies at the forefront of AI. There is no artificial intelligence sector or industry group like there is in the technology sector or insurance industry. The current AI value-chain can be partitioned into three categories: 1) there are chip producers such as Nvidia and Taiwan Semiconductor, 2) the companies that produce the AI products such as ChatGPT. ChatGPT was created by OpenAI, which is not a publicly traded company. It was initially launched as a nonprofit but has since created a for-profit arm. Microsoft is a significant investor in Open AI. Other companies, such as Google, Amazon, and IBM, have invested in AI for years. 3) There are the end-users of AI who seek greater consumer satisfaction and productivity gains. An example here is Netflix with its recommendation algorithm. The Magnificent 7 now comprise 27% of the S&P 500, so you likely have significant exposure

The chart below shows the sharp increase in PE multiples from the beginning of the year to today for the Magnificent 7. Nivida’s forward PE exploded from 51 to 205 times earnings during this period. As such, we should be prudent against rear-view mirror investing or following the “FOMO” trade.

Magnificient 7 Valuations

| NVDA | META | AMZN | GOOGL | MSFT | AAPL | TSLA | |

| Current Forward PE | 205X | 26X | 141X | 25X | 36X | 33X | 76X |

| Forward PE Jan 2023 | 51X | 11X | 99X | 17X | 26X | 21X | 38X |

While CHAT GPT can ace the bar exam and AP bio, AI still can’t provide you with a framework and the tools to live your best financial life. AI still can’t help you avoid the emotional cycle of investing, selling out of fear when prices are low and buying out of greed when prices are high. Nor can AI discuss the pros and cons of major financial decisions based on your unique situations under a fiduciary standard of care.

Until such a day comes, feel free to contact me with any questions you may have.