Sometimes, scary circumstances may end up helping us far more than we expect…

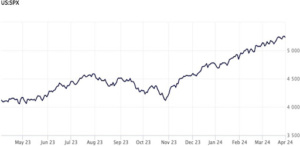

As of this writing:

- The S&P 500 index is 22.9 percent off its January 3 peak (having slightly increased last session from -23.1 percent), officially in bear market territory.

- The NASDAQ Composite Index is worse, off its peak by 32.9 percent.

- Even the Dow Jones Industrial Average is 18.8 percent off its peak, nearly in bear market territory.

Worse, many expect the markets to continue declining, potentially by a lot.

If you’re a young investor, this may be your first bear market experience, if we neglect the super-fast bear-and-recovery of early 2020. If so, you couldn’t be faulted if you become scared of the stock market.

“The Blessing of a Skinned Knee”

In 2001, author Wendy Mogel published a book titled “The Blessing of a Skinned Knee: Using Timeless Teachings to Raise Self-Reliant Children.”

In the book she points out that as parents, letting our kids experience lesser injuries or setbacks helps them become more resilient, self-reliant, and respectful. She opens the book with a quote from Lady Allen of Hartwood, “Better a broken bone than a broken spirit.”

This isn’t to call you a child, but what if you look at this crash as such a lesser injury that can teach you to be resilient in the face of investing adversity, self-reliant rather than following the herd over a cliff, and respectful of the nature of the stock market?

As Ayad Amary, MBA, CFP®, AIF®, VP and Senior Wealth Advisor at Wealthcare of the Lehigh Valley says, “One positive that can come out of this type of market decline is that it reveals to you if you’re taking the appropriate amount of risk.

“If you’re getting overly emotional due to this heightened volatility or worse, on the verge of panic selling, you’ve likely overestimated the level of risk you can tolerate. Although it may be too late to make changes at this point, you can and should use this experience to better prepare you for future bear markets, by moderating your portfolio’s risk level once it recovers. Knowing more about your own risk tolerance can prevent you from making a major mistake.”

So, consider this setback like Lady Allen’s “broken bone,” that will mend in due time, and don’t let it break your investing spirit, since that spirit is what will let you build wealth over the coming decades.

When Your Portfolio Drops, Do This

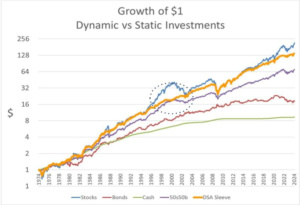

Another way you can benefit even more from this market crash is through shrewd rebalancing.

Ayad Amary makes the following recommendation, “It’s critical to use market declines such as we’re experiencing now to rebalance your portfolio. Yes, most asset classes are down, but some have been sold off more than others.

“Rebalancing to your initial equity risk allocation will let your account recover faster as the market begins to recover vs. simply riding the downs and ups. Rebalancing ensures you take a consistent level of risk. It’s one of the few things you can control as an investor.”

The Bottom Line

There is an old Chinese parable of a farmer (retold by Alexander Atkins) that speaks to good and ill fortune. Ultimately, things that appear to be bad fortune may turn out for the best, while things that initially seem good luck may turn out for the worse.

We should learn from the parable that we’d do best by accepting what happens that’s beyond our control, and trying to make the best of it.

This is true of the current market crash too. We can learn from it to be better prepared in the future, and take action now that makes the eventual outcome more likely to be for the good than the bad.

If you take these lessons to heart, do what you can and should (rebalance), and avoid what you should not do (panic-sell), in the long run, this market crash can end up being a blessing in a scary disguise.

If you enjoyed this piece and want to read more Medium articles, by me or any other writer, consider becoming a Medium member using my referral link. For $0.14/day you gain access to millions of articles, and a portion of your membership fee goes to the writers you read…

Written by Opher Ganel June 21st, 2022

Disclaimer

This article is intended for informational purposes only, and should not be considered financial, investment, business, tax, or legal advice. You should consult a relevant professional before making any major decisions.