Yes, it’s a bear.

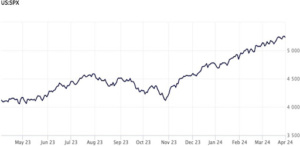

As of the 6/13/2022 close, the S&P 500 lost over 20 percent of its value since its 1/3/2022 peak (-21.6 percent at the recent low, recovering slightly to -20.5 percent as of this writing).

If you’re thinking you’d best pull your money out of the stock market (or have already done so), and/or that you don’t want to invest more of your money in the market, you aren’t alone.

That’s because it’s really hard to see a large fraction of your wealth evaporate.

It’s even harder when it grinds down over an extended period of time, and especially when the market teases you repeatedly with multiple “dead-cat bounces” that raise your hope that the worst is behind us, only to dash it when the index drops even further.

Wanna Try Timing the Market?

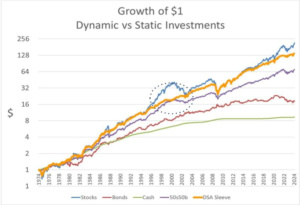

If you have a functioning crystal ball (mine stopped working a long time ago), you can yank your money out of the market at the top, wait until we hit bottom, and then jump in just in time for the market’s eventual recovery.

Because historically, the market always recovers, and goes even higher than it was before the bear.

But as Joshua Lutkemuller, CFA, Investment Advisor and Head of Portfolio Strategy at Strongside Asset Management says, “When in a bear market, the likelihood of finding the ‘perfect bottom’ is a pipe dream, which is why you must accept that short-term dips might move against you temporarily.

“But as a long-term investor you have time on your side, and the ability to recover from such short-term losses. All in all, these are the types of opportunities that tend to deliver outsized returns in the long run.”

What happens if you try to avoid the pain of bear markets?

According to Hartford Funds, “Half of the S&P 500 Index’s strongest days in the last 20 years occurred during a bear market. Another 34 percent of the market’s best days took place in the first two months of a bull market — before it was clear a bull market had begun.” The 20 years refers to 12/16/01 — 12/15/21.

You can’t avoid the pain of bear-market losses without missing out on more than five in six of the best days of the market.

Bear Markets Are a Natural (and Useful) Part of Stock-Market Investing

Will we have a bull market after this bear?

History says we will.

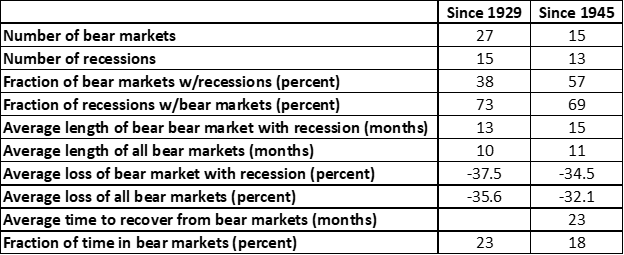

Since 1929, we’ve had 27 bear markets (counting this one), of which 15 were in the modern era (since WW-II). And each of those (excluding this one, for obvious reasons — it’s not done yet), was followed by a bull market.

And if a bull market does come to end the current bear, will that bull be followed by another bear? Again, history says yes.

Lutkemuller adds, “It’s important to understand that during the 18 months prior to 2022, we were blessed with insanely low volatility and outsized returns. In a lot of ways, that spoiled us. Bear markets aren’t all that rare, in fact, they happen every 3.5 years on average [since 1929; every five years in the modern era — OG]. If this is your first bear market, I can almost guarantee it won’t be your last.

“That’s why it’s so important to understand the dynamics of a bear market and adopt a mindset that views this turbulent market more as an ‘opportunity’ rather than a time to cash in all your chips and run. You should find resolve in the fact that bull markets last much longer on average and tend to deliver positive moves that are far greater than bear market losses.”

What are those dynamics? As shown in the table below, in the modern era:

- Stocks spent 18 percent of the time in bear markets. Of course, that means they spent the other 82 percent of the time in bull markets.

- The average bear market lasted (peak to trough) 11 months. If the economy fell into recession, the average length increased to 15 months. We’re currently 5.5 months into this bear market, and of the other 14 bears since WW-II, three didn’t even last this long.

- The average loss during a bear market (peak to trough) was -32.1 percent. If the economy fell into recession, the average loss was a little worse, at -34.5 percent.

- The average time the market took to recover to its pre-bear-market level was 23 months.

- Not every bear market sees the economy fall into recession, and not every recession sees stocks fall into a bear market. Just under six in 10 bear markets coincided with a recession, and about seven in 10 recessions coincided with a bear market.

What does all this mean?

Three simple things:

- We’re in a bear market.

- The bear will continue for as long as it continues, and go as low as it will go

- Anyone who tells you he knows how long it will last or how much further the market will fall is lying to you (or to himself).

We can only let history guide us. So what does history say?

- If this bear ends up on the shorter end of bear markets, it may already be over. If it ties the longest in the modern era (the 1973/74 bear), we have 15.5 months to go. If it ends up about average, we’re about halfway through.

- If it’s over already, it would be the second shallowest bear market in the modern era. If it ends up as bad as the worst since WW-II, it’s gonna drop another 39 percent from its recent low. If it ends up about average, we’re in for about a 13 percent further drop.

Why Stocks Are More Compelling Now, Not Less

The first reason is that the so-called Cyclically Adjusted Price to Earnings (CAPE) ratio, also knows as Shiller’s P/E ratio, was nearly 40 back in December.

The Bear Is Here! Why That’s (Mostly) Awesome Portfolio News

And what we can expect now…

That’s more than double the CAPE’s long-term average of about 17. Historically, when the market’s CAPE was that high, it presaged a market downturn.

The S&P 500’s CAPE is now about 32.5. Still historically high, but much less exuberant than it was six months ago.

The second reason is related to the first. The further stocks drop, the smaller your downside risk, and the larger your upside benefit. Conversely, the higher the market climbs, the more things are flipped, with greater downside risk and smaller upside.

Ian Weiner, CFP® says, “The data we have about market declines since 1926 shows that after a decline of 10 percent or more (certainly where we are) the average annualized returns for the next year was 11.4 percent, over the next three years 10.3 percent, and over the next five years 9.6 percent. This isn’t a guarantee of what’s to come, yet it has to inform our thinking about market volatility. When you have time, volatility is your friend — if you own great assets.”

Lutkemuller agrees. “Valuations have compressed and now more and more stocks are trading at discounts we haven’t seen in many years. Coming into 2022, stocks were much more fully valued, but now in mid-2022, we are at the point where forward expected returns are much more attractive for investors who have a long-time horizon.”

The third reason is that bear markets are an opportunity to ensure you make more money by buying low. Ayad Amary, MBA, CFP®, AIF®, VP and Senior Wealth Advisor at Wealthcare of the Lehigh Valley explains, “This is the opportunity one waits for! It amazes me how average investors are willing to chase higher prices in bull markets yet run for cover when stocks are on sale during bear markets.

“As long as one maintains a long-term time horizon individual investors should absolutely continue to average money into this type of market. They will be rewarded during the next bull run…whenever that may be!”

Warren Buffet expressed similar thoughts. Writing in a letter to Berkshire Hathaway investors, he said he’s puzzled when the same people who’d be delighted if they found everything at the store on a half-off sale are dismayed when the stock market is 50 percent off, even though they’re net buyers of stocks.

The Bottom Line

Warren Buffet famously said, “I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

So, are others greedy now, or fearful? Just listen to the talking heads on TV, or read what pundits are saying. Then consider doing the opposite.

Written by Opher Ganel June 16th, 2022

Disclaimer

This article is intended for informational purposes only, and should not be considered financial, investment, business, tax, or legal advice. You should consult a relevant professional before making any major decisions.